Comparing Travel Insurance Policies: Key Considerations

Understanding Your Needs

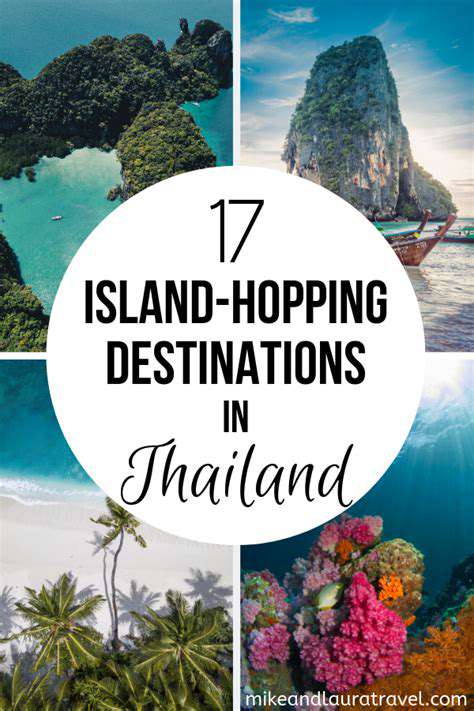

Before diving into the specifics of different policies, it's crucial to meticulously assess your travel plans and personal circumstances. Consider the duration of your trip, the destinations you'll be visiting, and the activities you intend to participate in. Are you planning a backpacking adventure through Southeast Asia, a luxurious cruise in the Caribbean, or a business trip to a foreign country? Different activities and locations carry varying risks, and a comprehensive understanding of these risks will be essential when choosing the right coverage.

Furthermore, think about your pre-existing medical conditions. If you have any health issues, be sure to disclose them to the insurance provider during the application process. This disclosure is vital to ensure you receive the appropriate coverage for any unforeseen medical emergencies that may arise. Failing to disclose relevant information could lead to your claim being denied in the event of a medical incident.

Comparing Policy Features

Once you've established your needs, the next step is to compare the specific features of various policies. Pay close attention to the coverage amounts for medical expenses, trip cancellations, baggage loss, and lost or delayed baggage. Compare these coverage amounts carefully to ensure that they align with your potential financial needs and the value of your trip.

In addition to coverage amounts, carefully review the policy's exclusions and limitations. Many policies exclude coverage for pre-existing conditions or activities deemed risky. Understanding these exclusions is crucial to avoid unpleasant surprises when making a claim. Read the fine print carefully to avoid any misunderstandings.

Another vital aspect is the claims process. Ensure that the procedure for filing a claim is clear and straightforward. A complicated claims process could prove frustrating and time-consuming during a stressful situation. Look for policies that offer transparent and efficient claim handling.

Evaluating Cost and Value

Price is often a significant factor in choosing travel insurance. However, don't solely focus on the cheapest option. A lower price tag might come with limited coverage, which could leave you vulnerable in the event of a significant medical emergency or unforeseen circumstance. Evaluate the total value of the coverage offered in relation to the cost of the policy. Compare policies with similar coverage levels to find the best value for your money.

Consider factors like the deductible amount, premium costs, and any additional fees. Analyze the terms and conditions carefully to understand the potential costs involved in making a claim. A policy with a higher deductible might offer a lower premium, but it could lead to a larger out-of-pocket expense if you need to make a claim.