Boosting Conversions with Instant Insurance Options

Leveraging Speed for Enhanced User Experience

A fast-loading website isn't just nice to have—it's absolutely critical for driving conversions. When pages take more than a few seconds to load, visitors quickly lose patience and abandon the site. Research shows that even a one-second delay can reduce conversions by 7%. To prevent this, focus on optimizing images, leveraging browser caching, and reducing unnecessary scripts. These technical improvements create a smoother experience that keeps users engaged.

The benefits extend beyond just user satisfaction. Search engines prioritize fast-loading sites in their rankings, meaning your optimization efforts can also boost organic visibility. This creates a virtuous cycle where better performance leads to more traffic, which in turn drives more conversions.

Implementing Effective Call-to-Actions (CTAs)

Your website's CTAs serve as signposts guiding visitors toward conversion. These elements need to stand out visually while clearly communicating what action you want users to take. The most effective CTAs use action-oriented language and create a sense of urgency. For example, Get Your Instant Quote Now performs better than a generic Learn More.

Testing different CTA variations through A/B testing reveals what resonates best with your audience. Small changes to button color, placement, or wording can sometimes dramatically impact click-through rates. Continually refining these elements ensures you're maximizing every conversion opportunity.

Optimizing Product Pages for Clarity and Value

Product pages must immediately communicate value while answering potential customer questions. Break down complex insurance products into easily digestible benefits using bullet points and clear headings. High-quality visuals that show real-world application of your services build trust better than stock photos ever could. Consider including short videos explaining coverage options to help visitors make informed decisions.

Streamlining Checkout Processes for Seamless Purchases

The checkout process should remove all unnecessary friction points. Implement features like autofill for returning customers and offer multiple payment options. Research indicates that nearly 70% of shopping carts are abandoned, often due to complicated checkout processes. By reducing form fields and clearly displaying security badges, you can significantly improve completion rates.

Utilizing Persuasive Language and Storytelling

Transform dry insurance features into compelling narratives that resonate emotionally. Instead of just listing policy details, show how your coverage protects what matters most to customers. Authentic customer stories about claims experiences build credibility better than any sales pitch. Use these testimonials strategically throughout the conversion funnel to address common objections.

Ensuring Mobile Friendliness for Broad Reach

With most web traffic now coming from mobile devices, your site must deliver an exceptional experience on smaller screens. Mobile-optimized sites see conversion rates up to 5 times higher than those not optimized for smartphones. Test all forms and CTAs on various devices to ensure easy navigation with touch controls. Pay special attention to font sizes and button spacing to prevent frustrating misclicks.

Technology Integration and System Compatibility

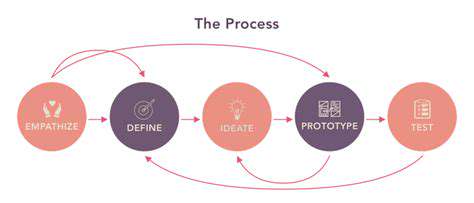

Technology Integration for Seamless Operations

Modern insurance platforms require deep integration with multiple systems to deliver instant quotes and policy issuance. This technical foundation must support real-time data exchange between booking systems, payment processors, and underwriting engines. APIs have become the backbone of these integrations, allowing different systems to communicate securely and efficiently. The architecture must also accommodate future growth, with the ability to add new partners or products without major redevelopment.

Security remains paramount in these integrations. Implementing end-to-end encryption for all data transfers protects sensitive customer information while maintaining compliance with financial regulations like PCI DSS and GDPR. Regular penetration testing helps identify and address vulnerabilities before they can be exploited.

System Compatibility and Interoperability

True system compatibility goes beyond basic connectivity—it requires designing interfaces that work seamlessly across diverse platforms. This includes adapting to different data formats used by travel agencies, airlines, and hotel booking systems. The most successful integrations anticipate edge cases and handle them gracefully, such as when a partner system experiences downtime or returns unexpected data formats.

Cross-platform functionality ensures customers can manage policies from any device. Responsive design principles should extend to the entire customer journey, from initial quote to claims submission. This omnichannel approach meets customers where they are, whether they're using a desktop computer at home or a smartphone at the airport.

Data Management and Reporting

Sophisticated data management transforms raw information into actionable business intelligence. Modern systems should track everything from quote abandonment rates to claims processing times. Advanced analytics can reveal patterns that help refine underwriting models and identify upsell opportunities. For example, noticing that customers who purchase cancellation coverage often later add baggage protection might suggest bundling these options.

Compliance requires meticulous data governance. Implement automated processes for data retention and deletion to meet regulatory requirements. Audit trails should track all access to sensitive customer data, creating accountability while enabling quick resolution of any privacy concerns.